In an attempt to navigate towards a more profitable business model, Uber is working on a potential acquisition of the mobile food delivery app, Grubhub. A move like this would cement Uber CEO Dana Khosrowshahi’s reputation as an acquisition oriented business leader. This move comes as companies such as Uber and Lyft, who are notoriously focused on revenue growth over short term profits, look towards consolidation as a means of developing synergies to cut costs and increase profit margins.

Acquiring Grubhub would be a major step for Uber in achieving the scale necessary to render their services profitable, but there are a few hurdles standing in the way of closing the deal. The challenges that Uber faces are the regulatory backlash that would result from a deal between two companies with such large market share, and other potential suitors looking to consolidate through an acquisition of Grubhub. First off, we must address the antitrust risk. In recent years, Congress has become more strict when vetting mergers to avoid the creation of any monopolies or market manipulating forces. It is a topic most prevalent in the tech industry today, especially with big firms such as Google and Amazon drawing attention in antitrust charges over their dominant position in their respective fields. The same scrutiny would apply to an Uber-Grubhub deal, as it would remove a competitor from a space in which only a handful of companies are reliable market leaders. It is an expensive risk which was taken into account through Grubhub’s request for a breakup fee triggered in the event that the deal is blocked. In the case of an Uber-Grubhub deal, I see consolidation as being absolutely necessary for the long-term survival and sustainability of the firms because it would get the company towards profitability much sooner.

Unfortunately for Uber, they are not the only company trying to put together a deal for Grubhub. Two European companies, Just Eat Takeaway (Netherlands) and Delivery Hero (Germany), are also in talks with Grubhub. Just Eat Takeaway is said to be in advanced talks and may snag the deal away from Uber. From Uber’s perspective, it is important to weigh the risks included in closing a deal for Grubhub. They could be missing out on an opportunity to increase scale and develop extremely valuable synergies, but the added pressure from other suitors might make them rush into an unfavorable antitrust-ridden deal.

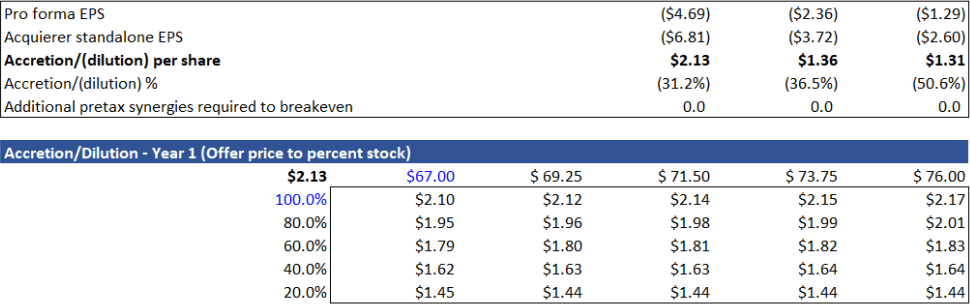

The deal structure is key to Uber executing on the proposed acquisition. Just Eat Takeaway’s latest offer is structured as an all stock deal, so I implemented similar assumptions into my excel model. Grubhub is said to be seeking an exchange ratio of 2.15 Uber shares/Grubhub shares, but latest talks state an exchange ratio of 1.925. Luckily for Uber, they have a lot of room to work with when it comes to pricing the deal as we’ll see later in the sensitivity table. The assumptions in the screenshot to the left value the deal at over $6 billion. All stock deals are especially favorable today because of how high market valuations are reaching, creating an environment for more expensive stock prices. With a business model working towards achieving profitability, it is important that no percentage of cash is misallocated.

As a strategic acquisition, a deal for Uber must be accretive in order for it to be worth pursuing. With potential synergies coming in at $1.9 billion, a potential deal could be accretive for Uber by $2.13 per share. It is a move that will work in the long run as Uber continues to shape their business towards a more mature model. The accretion/dilution sensitivity table above shows how crucial an all stock deal is, allowing Uber to be flexible when it comes to the offer price.

Consolidation tends to be the most persistent theme in industries where growth companies are taking over despite not having a clear path to profitability. These companies need to achieve scale, and fast, in order to avoid burning through all their resources before realizing their full potential. Whether Uber-Grubhub talks fall through and Just Eat Takeaway picks up the deal is yet to be seen, so I will be actively following the headlines and further report if anything is finalized. Thank you for reading, and as always the excel model I built is included to download at the end of this post. What are your thoughts on revenue focused startups that disrupt industries before even establishing profitability?

Update (06/11/2020): https://asvpcapital.finance.blog/2020/06/11/grubhub-turns-down-uber-closes-deal-w-just-eat-takeaway/

Great read! I don’t think this will be happening soon given the current climate.

LikeLike