Well over a year after the start of pandemic lockdowns, companies are still assessing the risks and bottom-line implications of COVID-19. Caught in the middle of it all is Corsair, whose gamer and content creator-oriented products faced increased demand amidst stay-at-home orders and industry-wide supply shortages.

The company’s products are split among two categories:

- Gamer and creator peripherals, which include keyboards, headsets, mice, and more.

- Gaming components and systems, which include RAM sticks, PC cooling systems, case fans, and more.

These products target both the casual, first-time gamer as well as the enthusiast who demands high-quality professional grade gear to enhance their gaming experience.

Accelerated growth in gaming, esports, and streaming

The sudden need to adapt and improvise throughout the pandemic has sparked a priority shift in people’s habits and needs, which has helped propel many industries forward. Gaming in particular has become more widely adopted as people find solace in the comfort of their own homes. The role of video games in society has changed dramatically over the years. No longer is it considered a mindless drain of time exclusive to kids and young adults, but rather an escape into an online community where people from across the globe can immerse themselves into other worlds and share experiences.

Furthermore, this widespread acceptance has allowed professional gamers and content creators alike to gain bigger platforms as eSports continue to evolve and sites like YouTube and Twitch become people’s primary means for entertainment. The legitimization of eSports is a key growth catalyst since it can create a whole new world of technology and service innovations intended to improve performance for players in big tournaments. Corsair is best positioned to capture this rapidly growing market through its comprehensive product offerings that make up a complete gaming/streaming ecosystem. Its competitive advantage lies in the fact that the company is there for the entire PC gaming journey; from the initial PC build to upgrading and maintaining the whole setup. CEO Andy Paul, who co-founded the company in 1994, commented on the company’s latest earnings call that his “belief is that the situation in 2020 and early 2021, where gamers spent more time home, learning to play better, that should establish a higher base of consumers ready to step up and upgrade their gaming setup” (1).

The Elgato brand, acquired back in 2018, unlocked heaves of potential and secured a company that has become synonymous with streaming. The big advantage the Elgato brand provides the company is in higher margin products. Some of the most notable products Elgato offers streamers are $200 ring lights, $160 microphones, the $150 stream deck, and the recent release of their first webcam, which currently sells for $200. The biggest streamers on platforms like Twitch broadcast themselves from setups featuring a mix of all these products. The association with streamers will help influence customers who want to build setups similar to that of their favorite creators. The more Corsair is able to expand its product offerings to cover more facets of gaming/streaming on PCs, the more its total addressable market will continue to grow.

Global Supply Chain Shortages

Modern society has transitioned into an age where almost everything you buy comes equipped with a CPU to power the latest features in technology. A perfect storm of technological innovation coupled with overwhelming demand gave way to the semiconductor shortage that slowed production in everything from cars to smart home appliances. For gamers, this meant that their PC build plans, or upgrades, would have to be put on hold while they waited for key components like AMD’s CPUs, NVIDIA’s graphics cards, and even Corsair’s power supplies to come back in stock.

Corsair’s management team is proving its resilience through the situation as they reported growth in every product category on their latest Q2 earnings call. CEO Andy Paul, who co-founded the company in 1994, commented that because of the shortages, “we believe there is a large number of gaming enthusiasts in the wings waiting to build a new PC on top of the elevated numbers of people that actually did build a new gaming rig” (1). This is encouraging considering the company delivered its second-best quarter ever for net revenue and gross profit growth despite not having as much supply as it would have liked. The pent-up demand should continue to drive Corsair’s momentum beyond the pandemic tailwinds that boosted sales growth from about 24% in the pre-COVID US, to approximately 80% once lockdowns were instated.

Long-term debt management

Corsair’s Q2 earnings call highlighted plenty of strengths despite the headline earnings miss. Most notably, the company is directing $25M in Q2 operating cash flows towards paying down debt. This brings its year-to-date debt paydown total to $53M with an additional $47M expected to be paid off in the second half of the year.

Earlier in the year, S&P upgraded the company’s corporate credit rating from B+ to BB-. More good news fell upon the company in June when Moody’s also decided to issue an upgrade of its own, increasing Corsair’s corporate credit rating from B1 to ba3. In the accompanying research, Moody’s stated that the upgrade “reflects the strong demand for the company’s gaming and streaming peripherals and gaming hardware products, leading to strong operating performance and reduced leverage” (2). It also mentioned that “Corsair’s low leverage and solid free cash flow coupled with good product development capabilities provide flexibility to maintain the strong reinvestment and marketing necessary to sustain and improve the company’s market share” (2). The company’s stock price reacted well to the upgrade, as investors pushed the price up as much as 20% in the month of June following the announcement. Strong credit management will give the company the flexibility it needs to continue scaling up and capturing market share through lowered interest expense and easier access to capital.

Financials and valuation

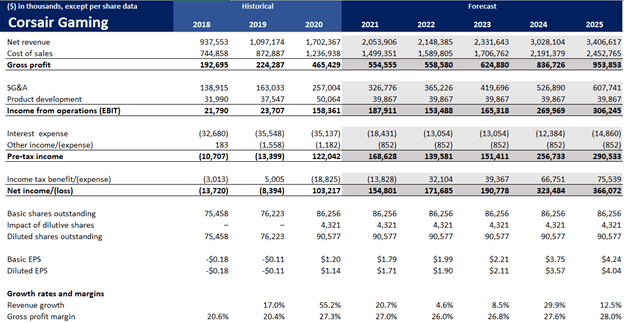

I modeled Corsair’s financials based on analyst consensus estimates for revenue and EPS growth through to 2025. On Corsair’s Q1 earnings call, management raised guidance given the strong start to the year and positive demand trends. Under management’s new forecast, revenues would come in between $1.9B and $2.1B, up from the original figure of $1.8B to $1.95B. Adjusted operating income is projected in the range of $245M to $265M, which will be key to executing on the $100M debt reduction plans for the full year.

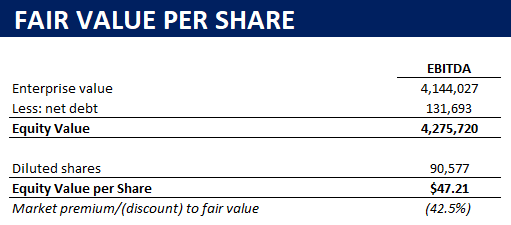

To arrive at Corsair’s intrinsic value, I built out a discounted cash flow model and valued the company using a peer group average EV-to-EBITDA of 10.9x (The sample group included Corsair, Logitech, Razer, ASUS, Dell, and HP). For the WACC, I calculated 5.3% based on a 5.4% cost of equity and 3.2% cost of debt with equity making up the majority of the capital structure.

At an equity value of $4,275,720 (in thousands), I calculated a fair value per share of $47.21. This implies that shares are trading at a 41.5% market discount given Friday’s closing price of $27.64. Shares have been trading at under $30 for the month of August so far, a roughly 30% fall from three-month highs. Some of the selling activity pushing the price down could be attributed to EagleTree Capital, who took a roughly 92% stake in the company before it was publicly traded, cashing in on a portion of the investment. According to Corsair’s recent Schedule 13 G/A SEC filing, EagleTree Capital’s position now stands at around 60%. Shares could start trending towards the $47.21 price target over the next months as the institutional selling pressure subsides.

Several fundamental measures also suggest that Corsair shares are cheap right now relative to its main competitor, Logitech. Corsair trades at a FWD price-to-earnings ratio of 19.70 while Logitech’s FWD price-to-earnings ratio sits at 27.16. Price-to-sales and EV-to-EBITDA also imply a discount with Corsair trading at multiples 27% and 69% lower, respectively, compared to that of Logitech. These levels represent a favorable price to open or add to a position in Corsair and capture growth as the company execute its strategy to gain more market share.

Risks

There are several risks to take into account when considering an investment in Corsair stock. Cloud computing is a risk that stands out among those mentioned in the MD&A from Corsair’s latest 10-K. The cloud computing industry is increasing at a rapid pace, providing software solutions at both the individual and enterprise level. If cloud computing capabilities keep advancing to the point where high-performance computers could be accessed over the internet on dummy terminals, it could have a big effect on demand for Corsair’s PC component hardware. It is thus imperative that the company maintains its pace of product launches and investments in R&D to keep up with the technological capabilities cloud computing could unlock.

That leads to the second risk, which is Corsair struggling/failing to keep up with new product releases. Technological innovation moves fast, especially when it comes to PCs and gaming, so it is necessary that the company delivers differentiated products to gain an edge over competitors. The company has made its commitment to releasing products on a regular basis clear, having launched over 75 new products in 2021 so far. A slowdown in its product pipeline could result in the company falling behind its competitors and losing its reputation as a leader in high-quality, professional grade PC components and peripherals.

The third risk to highlight is Corsair’s reliance on Amazon sales channels. In the MD&A from Corsair’s latest 10-K, management stated that “in 2020, 2019, and 2018, Amazon accounted for more than 10% of our net revenue, at 24.6%, 25.1% and 22.4%, respectively” (3). One issue that this presents is the lack of accounts receivable insurance for orders made over Amazon; this could create uncertain revenue forecasts as potential customer defaults are left unprotected. The other issue is that any change in policy over at Amazon, or a decision to reduce/stop selling Corsair’s products on the site, will have a significant impact on the company’s financial position. The company has already made strides in developing its direct-to-consumers sales channel through its acquisition of SCUF and Origin, which has helped lift the direct-to-consumer sales channel as a percentage of revenue.

The final risk is to note is the potential timeline in regard to the global semiconductor shortages. If the situation becomes drawn out longer than expected, Corsair will be missing out on sales by not being able to meet supply with demand. This could also stunt innovation in the industry as companies wait for operations to resume at normal levels.

Conclusion

The SWOT analysis below summarizes Corsair’s competitive profile.

While Corsair may face competition and headwinds coming from many different angles, the company’s robust product offerings are a competitive advantage that will serve to increase its total addressable market as eSports and streaming continue to grow. Amidst the selling pressure and Q2 earnings miss that have pushed the stock price down, now is a favorable time to increase or open a position in Corsair as it works toward a long-term price target of $47.21. I expect the price will continue to fluctuate in the short-term as the newly public company tries to find its footing in the stock market.

DISCLOSURE: I own a position in Corsair under 100 shares.

References

- https://seekingalpha.com/article/4444430-corsair-gaming-inc-crsr-ceo-andrew-paul-on-q2-2021-results-earnings-call-transcript

- https://www.moodys.com/research/Moodys-upgrades-Corsairs-CFR-to-Ba3-outlook-stable–PR_447863

- https://www.sec.gov/ix?doc=/Archives/edgar/data/1743759/000156459021012507/crsr-10k_20201231.htm