This article was originally published on 6/25/2021 here: https://www.kennedypinecapital.com/post/lululemon-goes-beyond-athleisure

While many companies may have benefited from 2020 trends like work from home and increased government stimulus, only a few are positioned to maintain the accelerated level of performance they were afforded during the pandemic year. Lululemon, whose offerings include some of the most high-quality products in athleisure, is set to capitalize on the market opportunity to drive expansion beyond their current business model. The company and its stock price have seen considerable growth over the past five years, with shares appreciating almost 400% in that time, as revenues climbed at a 16.4% compound annual growth rate (CAGR). More exciting, however, is what’s ahead for Lululemon with cutting edge technology and new product launches leading the way.

Pandemic-related store closures hit Lululemon as hard as many other retailers that were forced to lockup through the uncertainty in 2020. Despite a shaky start to the fiscal year, Lululemon’s sales were lifted thanks to the strength of its ecommerce channel, which grew 93% y-o-y in 4Q2020. This growth was well ahead of the guidance management laid out in their ‘Power of 3’ growth strategy, allowing the company to “…achieve, three years early, our 2023 goal of doubling our ecommerce revenue from 2018 levels,” according to CEO Calvin McDonald. This speaks to the strength of Lululemon’s brand as athleisure over traditional sportswear since customers were still buying their products despite having to stay home while gyms were closed. Anita Balchandani, a partner at McKinsey & Co’s London office, described on The McKinsey Podcast that “People have realized that clothing that’s comfortable, that feels well, that feels good, that is well made has become much more important… so that probably is something that will continue”1. To Lululemon’s credit, its ecommerce channels were able to handle the unanticipated demand boost to continue delivering sales while also driving user engagement on its online platforms. The company can successfully capture the momentum from its 2020 gains through the unveiling of its customer loyalty program, which should be a hit given how strongly customers feel about the brand.

Along with more than doubling digital revenues by 2023, the company’s ‘Power of 3’ growth strategy also includes doubling men’s revenue by 2023 and quadrupling international revenues by 2023. As of their latest 10-K (03/30/2021), men’s product sales are up 38% since 2018. One factor we anticipate will drive growth in the men’s segment is the future launch of Lululemon’s footwear. Expanding into footwear marks a big step for the company that will serve to broaden its customer base while also opening the door to venture into product lines associated with different sports (and potentially even athletes, similar to what Uniqlo has done in its partnership with Roger Federer). Footwear will also make the company a top-to-bottom clothing brand, which we expect will promote brand loyalty as customers can now put together entire outfits consisting of only Lululemon gear.

International expansion, which makes up the third spoke in the ‘Power of 3’ growth plan, has a lot of runway to grow. Since 2018, revenues outside of North America grew 73% to make up almost 15% of Lululemon’s total revenue. CEO Calvin McDonald is bullish on the opportunity to grow internationally, stating that the revenue split can be as high as “…50/50 in the years to come” 2. Adding stores in markets like Japan, South Korea, China, and Australia, will make reaching $1.44B in annual sales outside of North America not too far out. These regions are home to growing economies driven by a rising middle class that is looking to indulge in quality items like those offered by Lululemon.

MIRROR Acquisition

Subscription revenues are a valuable source of high margin recurring income and have thus become a popular business model everywhere from movie and tv streaming to online exercise and training platforms. Lululemon’s 2020 acquisition of MIRROR for $500M in cash allows the company to enter the fast-growing connected fitness equipment industry and earn subscription revenues. MIRROR’s flagship product provides users with live and on-demand exercise sessions with top trainers that they can access from the comfort of their own home. When not in use, MIRROR also doubles as a fully functional mirror. With lockdown orders keeping people away from the gym for most of 2020, demand for at home fitness equipment skyrocketed. This growth was marked by the performance of companies like Peloton, which has grown into a company generating $4B in revenue with a market cap of around $30B. Given these trends, we expect MIRROR will have a lot of runway to grow, especially as it assimilates into Lululemon’s core business. The investment has already exceeded management’s expectations, generating $170B in revenue for 2020, and offers Lululemon plenty of options to further integrate the technology into its business.

This strong start to the MIRROR investment has prompted management to invest heavily in accelerating company growth. Management laid out plans for the interactive mirror in their Q4 earnings call, which includes adding two more production studios to increase live classes, recruiting more instructors, and developing in-store experiences designed around MIRROR. Store reopening’s present an opportunity to introduce the technology to more customers and try it themselves. Furthermore, it can be used to facilitate the shopping experience if it features services like virtual fitting rooms to help customers make purchase decisions. Management recognizes this potential and is expecting MIRROR sales to increase up to 65% for a $275M contribution

Valuation

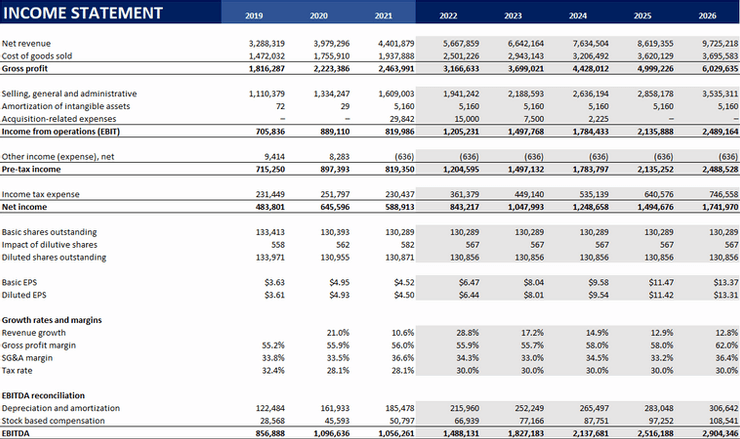

Using analyst consensus estimates for revenues and EPS, I forecasted Lululemon’s financial statements 5 years out to begin my valuation. Wall Street expects the company’s sales and earnings to grow at a CAGR of 17% and 23%, respectively. Considering the value MIRROR will unlock, even these growth rates could be understating Lululemon’s performance potential.

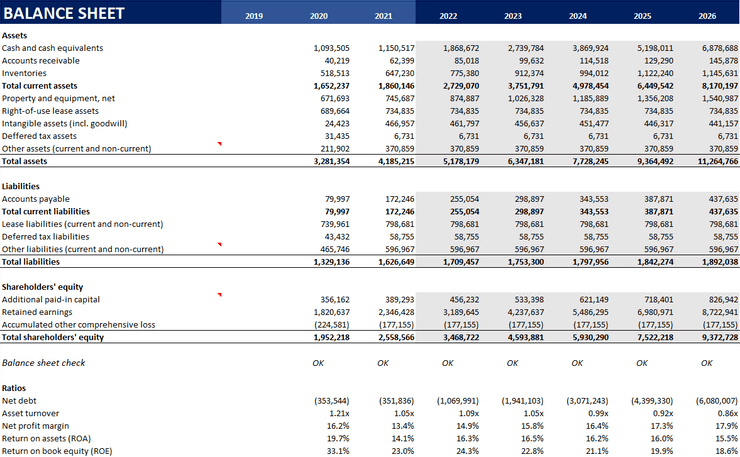

One of the biggest strengths on Lululemon’s balance sheet is the fact that it holds a negative net debt balance. It is able to hold such a low debt balance relative to cash because the company funds its operations primarily through operating leases. Assets financed by way of operating leases include “certain store and other retail locations, distribution centers, offices, and equipment” according to the company’s latest 10-K (03/30/2021). Using leases offers the company better rates on financing and less restrictive borrowing terms, while also alleviating the pressure of maintaining and replacing out-of-date equipment since the leased asset will be returned. This allows Lululemon enough flexibility to execute on its expansion and product development strategies and maintain an accelerated level of growth.

Some key assumptions I used in my discounted cash flow model were a WACC of 5.7% (consisting primarily of the cost of equity), a perpetual growth rate of 3.5%, and an exit EBITDA multiple of 32x. Enterprise values using the perpetuity and exit EBITDA multiple approach came in at roughly $66B and $77B, respectively. Arriving at the equity value per share, the model concluded that Lululemon’s shares trade at an average discount of around 40% from its intrinsic value. This implies a long-term price target of $500+ as the market begins to realize the company’s value coming out of the pandemic.

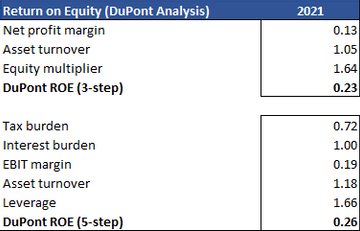

Further breaking down the company’s stock price potential using the DuPont 5-part ROE formula further shows the advantages of keeping a low debt balance with Lululemon’s interest burden consistently hovering at 1.0. The company’s DuPont ROE totals 26%, which is more than double that of most peers except Nike, whose DuPont ROE is 31.52%. Nike’s advantage in ROE comes from a higher leverage ratio of 3.89 that the company is able to maintain at an interest burden of 0.95. Getting more aggressive on leverage could serve to grow ROE and elevate earnings while granting Lululemon the funds to finance its ambitious expansion plans

Finally, the company’s P/E ratio (TTM) of 73.28 is higher than Adidas and Nike (55.41 and 63.99 respectively), but lower than Under Armour’s P/E of 85.89. Relative to Nike and Adidas, who have a stronger focus on footwear and are more mature in their life cycles, Lululemon has more growth opportunities at hand as it accelerates its international expansion plans, stretches into new product lines, and continues to innovate in its workout equipment and apparel technology. Under Armour, on the other hand, seems to trade at an expensive P/E relative to peers despite struggling to achieve profitability, indicating it’s stock may be overvalued. Lululemon has the highest P/S out of its peer group, at 9.76, which is expected considering the headroom it has through MIRROR’s subscription revenues to drive sales.

Risks

Lululemon’s products sell for a steep premium, exposing the company to the threat of lower cost competitors. Some brands have recently gone as far as indirectly referencing Lululemon’s high price tags in ads to sell low-cost substitute products. Additionally, recent concerns around inflation could impact the demand for a product that is already priced so high.

As people resume their daily commutes back to the office, the momentum from remote work that has been driving athleisure’s recent popularity may begin to slow. This would likely suppress sales volumes since a large portion of non-athletic-use customers would reduce their spending on Lululemon’s products.

Conclusion

Over the years, Lululemon has established itself as more than just an athletic apparel company. It instead created a sense of community among its loyal customer base who are drawn to the premium quality products and engaging in-store/online experiences. Lululemon is all about promoting an ‘active lifestyle’, which is what allows the brand’s reach to extend far beyond the gym or competition sports.

The company is in an encouraging position coming out of the pandemic. Store reopening and expansion will give Lululemon a platform to re-engage customers and show off future growth drivers like MIRROR and eventually footwear. Ecommerce will also continue to be a key sales channel as online shopping habits developed in the midst of the pandemic persist. Below I’ve put together a SWOT analysis outlining Lululemon’s competitive profile:

Shares currently trade around 15% off from 6-month highs, with any downward price movement reflecting a great opportunity to build a position in the company. Lululemon is set to report earnings next week on June 3rd, with analyst consensus forecasts anticipating 2Q2021 EPS of $0.90. The call will likely provide more color on topics like MIRROR’s integration and performance, store reopening’s/expansion, footwear, progress on the ‘Power of 3’ growth plan, and the rollout of their customer loyalty program. We are long-term bullish on Lululemon.

References

(1) https://www.mckinsey.com/industries/retail/our-insights/the-postpandemic-state-of-fashion#

(2) https://financialpost.com/financial-times/lululemon-plans-overseas-expansion-as-yogawear-booms