In what has been a hotly contested and controversial move, Xerox has been making moves to acquire HP. This potential deal is fascinating for a few reasons. The first being that Xerox is a much smaller company than HP with a market cap of $6.4 billion compared to HP’s $62 billion value. That would imply a high debt load on the newly merged company which makes it attractive for financial sponsors to participate, especially considering the steady cash flows of both businesses. Another reason why a deal between the two companies would make sense is because they are both leaders in the printer market. They differ in that HP focuses on smaller printers for the average household/office while Xerox specializes in enterprise printers. By combining the two, the new company is able to cut costs on labor, services, and parts with potential synergies of $1.5 billion. This deal is being pushed heavily by famed investor, Carl Icahn – who owns 11% of Xerox and 4.4% of HP. He sees great value in owning the combined entity. Deal talks have not been friendly however as Xerox is using aggressive takeover tactics by attempting to shake up HP’s board, leading HP to implement a poison pill.

The best way to analyze the deal and its intricacies is through a merger model (which I have built and attached at the bottom of this post). The excel file also includes a 3-statement model with DCF analysis on both companies to understand what the implied value of the deal might look like. This is important to analyze because one of HP’s claims against Xerox’s acquisition attempt is that it undervalues the target company.

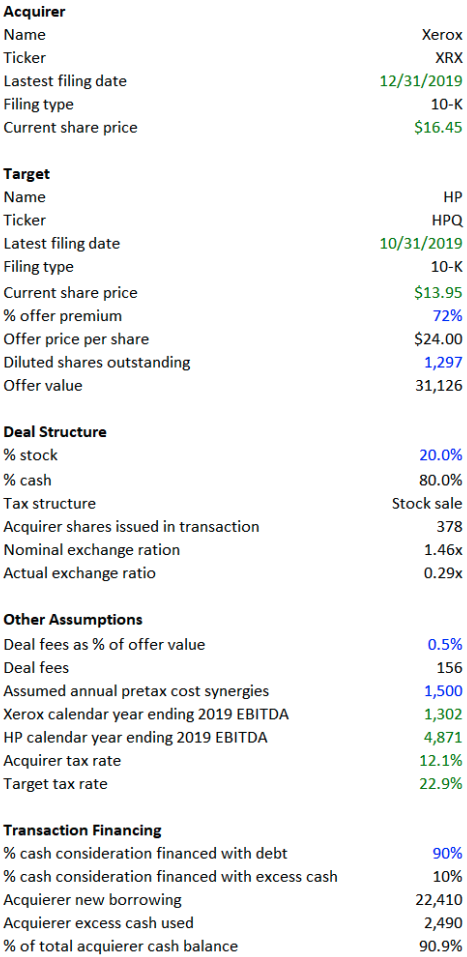

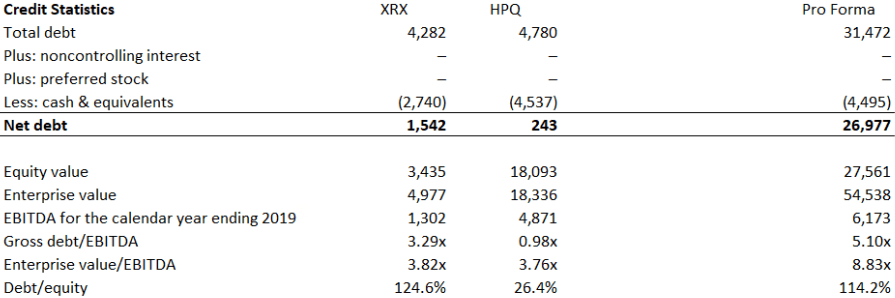

I began by modeling the deal structure. Xerox’s latest bid values HP at $24 per share, a 72% premium from the last closing price as of March 20, 2020. This values the deal at $31.126 billion. With a deal comprised of 20% stock and 80% cash, Xerox would have to issue 378 million shares in the transaction. Although the deal is 80% cash, only 10% of it would be financed through Xerox’s current cash holdings; the remainder would be financed with debt. In the Credit Statistics table below, we visualize how a highly leveraged deal would affect the newly combined company’s capital structure.

The pro forma net debt for the company comes out to almost $27 billion. A debt heavy structure is risky, but given the current low interest rate environment and the businesses’ steady cash flow generation, it is feasible. The deal would also create roughly $38 billion in goodwill for the combined company.

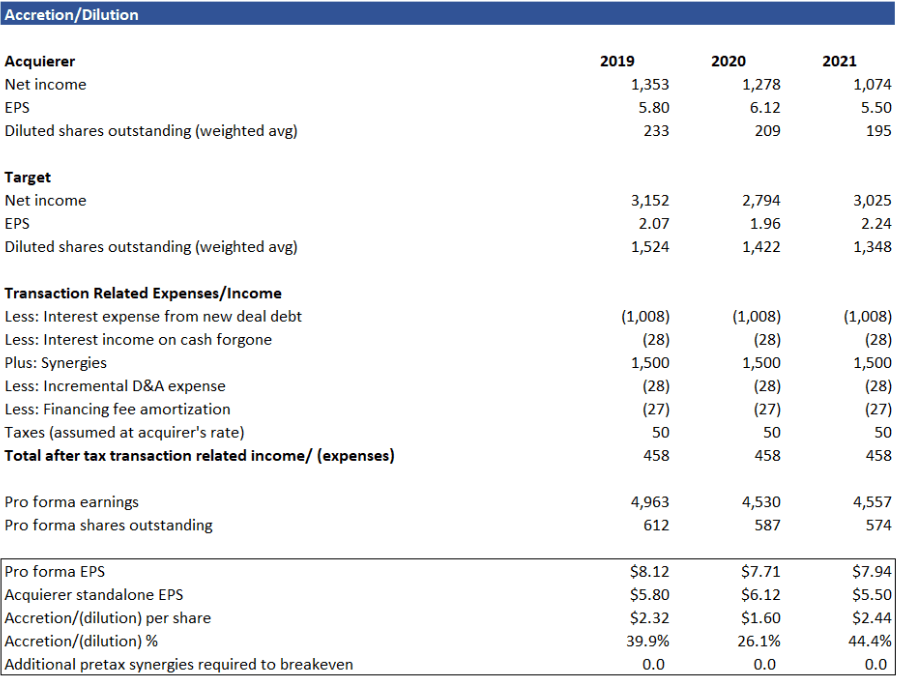

When it comes to analyzing any M&A deal, it is important to note whether the transaction is accretive or dilutive.

With the current deal structure assumptions and the state of both companies, the transaction is accretive by $2.32 per share. Typically, a strategic acquisition like this one results in an accretive deal because of the synergies that come along with the consolidation of the two businesses. The following years are also accretive by $1.60 and $2.44 respectively, showing that the deal is a good move in the long run.

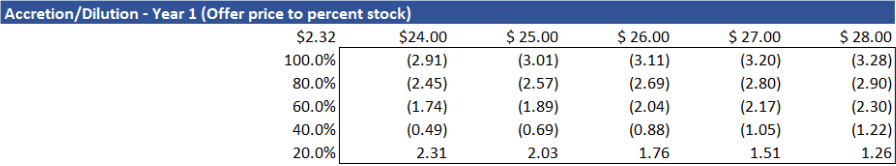

The sensitivity table above shows how changes in the offer price and deal structure change the accretion/(dilution) per share. The results display how important a highly leveraged deal is to making the transaction accretive. As the percent of stock financing goes up, the deal becomes more dilutive. Xerox also has room to possibly meet HP’s demands for a higher offer price while keeping the deal accretive with a 20% stock structure.

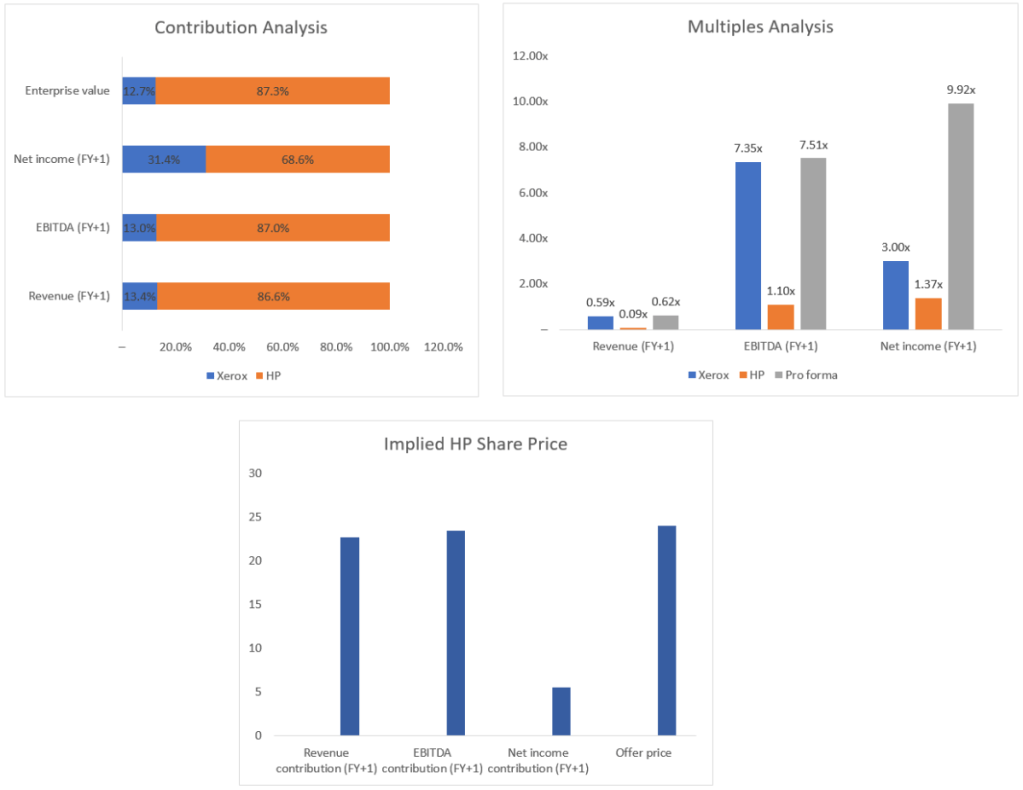

The charts above display the results from the contribution analysis portion of the model. The first chart on the left helps visualize how much each company contributes to the combined company’s pro forma enterprise value, net income, EBITDA, and revenue. HP, the much larger company, contributes to over 80% of the enterprise value, EBITDA, and revenue; 68.6% when it comes to net income. The bottom chart compares HP’s implied share price based on revenue, EBITDA, and net income contribution to the current offer price of $24. This signifies that the Xerox’s valuation is not that far off, and that Xerox would not have to go much higher to appease HP’s demands; possibly $2 to $4 higher.

Consolidation between these two companies creates a giant in the printing industry, covering both desktop and office printers. HP has said that despite the persistence from Xerox, they are open to talking through a deal. That may mean that if a deal happens, it may be HP buying Xerox, creating a combined company with much less debt, but with same synergies. Advances in 3D printing could come much quicker as a result, and their services will be much more efficient. There will probably be a delay before anything is finalized given the COVID-19 crisis, but the potential for a deal is still there to be realized.

Thank you for reading! I recommend taking a look at the complete excel model attached below. Feel free to comment or message me what you think about a potential merger, as well as any thoughts on the M&A landscape given the disruption stemming from COVID-19.

References

https://fortune.com/2020/03/16/xerox-hp-takeover/