After watching HBO’s Succession, I thought it would be interesting to draw comparisons between the real and fictional implications of the company that is at the center of the show. Based on real life media magnates like the Redstones and the Murdochs, the show portrays what it is like at the top of a global media entertainment and publishing behemoth. The fictional firm, “Waystar Royco,” is comparable to Rupert Murdoch’s News Corporation who at one point owned notable names such as 21st Century Fox, Fox Corporation, Dow Jones & Company, and News UK. In 2013, Rupert Murdoch decided to split the entertainment and publishing assets into separate entities. Throughout this post, I will take a closer look at the business described in Succession and also build an LBO model on News Corporation, basing my information from scenes in the show. Disclaimer: there may be some spoilers in the next two paragraphs.

Some of the most interesting plots in Succession follow the corporate drama and decision making amidst a power struggle for the top job at Waystar. In the first season, we see Kendall Roy (son of Logan Roy, CEO and Chairman of Waystar Royco) briefly takeover the CEO role while his father recovers from health issues. Upon assuming the role, he finds out that his father had taken out a $3 billion loan through a shell company that was now in violation of its debt covenant, which was tied to the company’s stock price. Following the news of Logan’s health issues, the stock dropped below $130, triggering the debt covenant and forcing Kendall to take action by receiving private equity capital and restructuring.

Logan, not ready to let go of his executive role, takes the throne back from Kendall after an unsuccessful attempt to permanently vote Logan off the board… much to Kendall’s dismay. In an attempt to regain control of the company, Kendall teams up with a close friend’s private equity firm to launch a $140 offer to take Waystar private. He has built up the board’s support, making the closing of the deal appear as if it is only a matter of time. This is the part of the show that inspired me to build an LBO model on News Corporation and see what the fictional deal would look like on its real life counterpart.

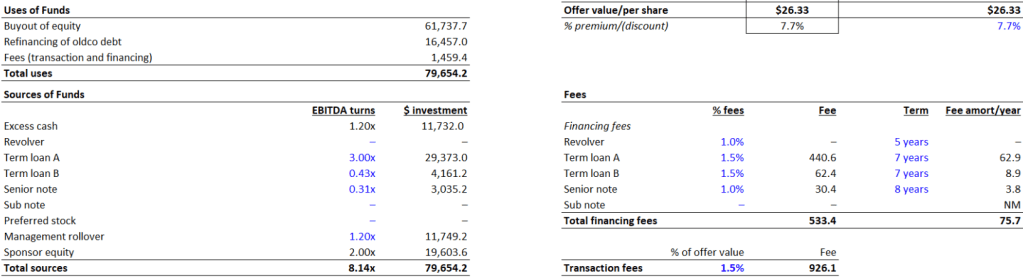

Assuming that at one point Waystar stock was trading around $130 and that Kendall would eventually launch a $140 offer, I used a 7.7% premium for the News Corporation offer (130/140 – 1). My model uses News Corporation’s 10-K from June 30, 2012 and September 30, 2012 because it was at this point that the company most resembled Waystar as Rupert Murdoch would shortly thereafter complete the split of entertainment and publishing, decreasing the overall size of the company.

As of their first quarter 10-Q from 2012, News Corporation’s stock traded at an average of $24.45. On a 7.7% premium, the price rises to $26.33, valuing the deal at $61.7 billion with 2.345 billion diluted shares outstanding at the time.

A deal the size of this requires an extraordinary amount of debt financing. Thankfully, News Corporation’s business generates large steady cash flows that would ease the load considering all the debt they would take on. In an LBO, the financial sponsor will typically sell off some of the businesses’ existing assets to help finance the deal. Considering that 21st Century Fox would eventually be acquired by Disney in 2019, we can assume that those assets are up for sale once the LBO is completed.

The image above displays the sources/uses of funds along with the financing fees. Since it is a majority family owned company, I factored in a management rollover of $11.75 billion so that the Murdochs retain a significant stake in the newly private company. This amounts to a 37.5% of ownership, while the financial sponsor picks up 62.5% ownership of the company. The funds raised in the Sources tab will be used to pay the offer value, deal fees, and refinancing of the old company’s debt. The deal fees are the transaction and financing fees to the right of the Sources/Uses tabs. Further down in the model is a debt schedule that goes through the payment details of the junior and senior tranches, showing how long the private company will hold a balance for.

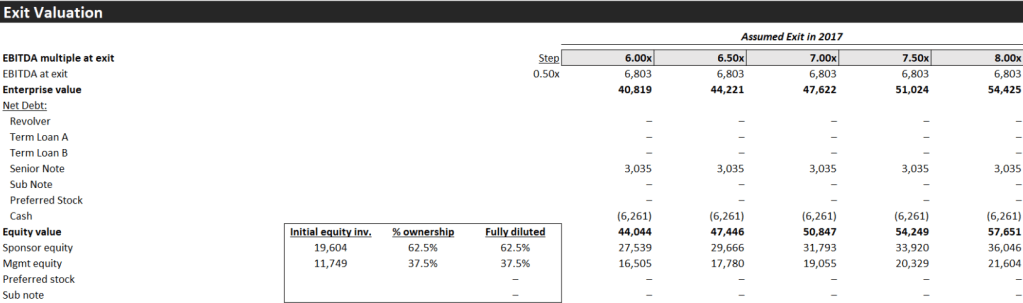

Private equity makes investments in companies that they expect to hold for around 3 to 5 years before making a return. The image above goes over the exit valuation of the investment in News Corporation at different EBITDA multiples. In the middle at 7x EBITDA, the company’s enterprise value falls to $47 billion from $61 billion at the start of the investment (not taking into account any sale of 21st Century Fox or other assets). The original enterprise value was driven by a higher LTM EBITDA than what was considered average for the company. The Income statement forecast calculated EBITDA at $6.3 billion in 2013 growing year over year to $6.8 billion in 2017. These numbers are more in line with the historical EBITDA, suggesting that the initial LTM EBITDA could be an outlier. Further down in the exit valuation is the management and sponsor equity, which has resulted in an IRR of 10.2% for both from the original $11.75 billion and $19.6 billion initially invested by both parties respectively.

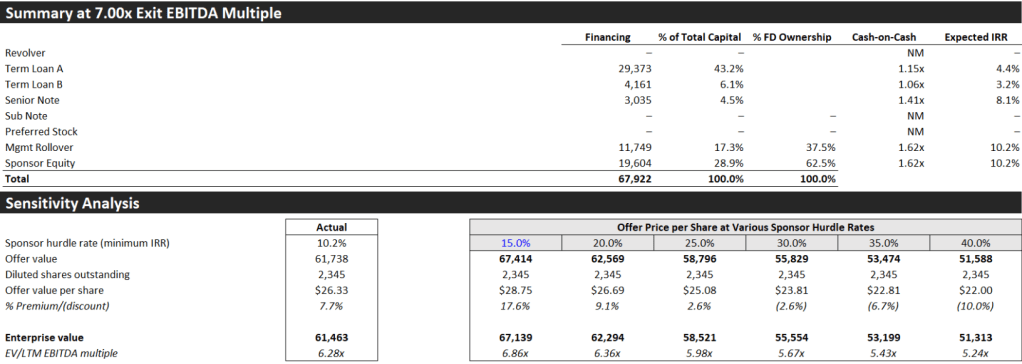

The Summary tab above consolidates the most relevant information based on the 7x EBITDA multiple at exit. The financing structure shows that over 50% of the deal was debt financed while 28.9% came from the financial sponsor and 17.3% came from previous equity rollover. Leverage is the key in an LBO that allows financial sponsors to purchase companies the size of News Corporation while only deploying a portion of the dry powder they have on hand, hence the name “Leveraged Buyout”. Along with the IRR for the rollover and sponsor, we see the IRR for the senior debt tranches. Below the summary is the sensitivity analysis with a data table showing the effect of various offer prices based on the hurdle rate, or minimum return, set by the private equity investor. The hurdle rate is important for investors to understand at what point do they decide to pursue an investment or not. For most private equity investments, an EV/LTM multiple above 6x is the typical threshold, as seen on the bottom of the table.

While this analysis is a completely fictional scenario, an LBO for News Corporation would be one of the biggest buyouts of all-time. It is also a deal that would be under immense political scrutiny as there is already plenty of controversy surrounding News Corporation and the idea that a small handful of corporations and families run about 90% of the news we receive on the daily. Although News Corporation no longer remains as the single giant entity it was before the asset split and eventual 21st century Fox acquisition by Disney, it is still a powerhouse as far as publishing and influencing the news. Succession gives a fascinating insider perspective to the internal politics, rifts, and drive for power that are typical in a family-owned conglomerate.

I hope you enjoyed reading, and please feel free to comment or message me any thoughts on the article or suggestions for future posts. I’ve attached the 10-K and 10-Q used for the LBO model as well as a download for the model itself so that you can take a deeper look at the numbers or use as a guide (turn on iterative calculations in your excel options/settings to avoid circularities).

References

https://www.sec.gov/Archives/edgar/data/1308161/000119312512460872/d428262d10q.htm#toc

https://www.sec.gov/Archives/edgar/data/1308161/000119312512355856/d389171d10k.htm#toc389171_12

I loved the article and the model. After your analysis, would you have encouraged an LBO to the Murdoch family? Would it have been in their best interests to do so financially all things considered? I recommend doing more creative articles like this. Maybe one reviewing the RJR Nabisco deal and how you could’ve perfected it now looking back at it. Or, what made Michael Milken’s high-yield bond department at Drexel Burnham Lambert in the ’80s so successful, and how did that help companies raise capital. The Street needs more content, please.

LikeLiked by 1 person

Hi Morgan,

Thanks for the response, I’m glad you enjoyed the article.

An LBO deal for a conglomerate like News Corporation probably would not happen for a couple of reasons. I would assume that the Murdochs would want to maintain the majority stake in their company and not be at the whim of their Private Equity owners, which could not happen if they take the company private. Another reason is the political backlash that would come from a deal this big involving a company as controversial as News Corporation, popular for the widespread use of tabloid news. Similar to how some financial sponsors were hesitant to take the Reynolds tobacco assets in the RJR Nabisco LBO you mentioned, there would be a similar sentiment with Rupert Murdoch’s firm. Considering that News Corporation’s Twenty-First Century Fox assets would eventually be sold to Disney however, you can make the case that certain assets would be attractive to financial sponsors, but not the company as a whole.

The RJR Nabisco deal is fascinating, especially considering that it did not turn out to be the investment that KKR thought it’d be. If I can get my hands on their annual reports and filings from that time period, I could definitely build a model on it knowing what we know today about the deal and how it went. Michael Milken’s junk bond revolution changed corporate strategy forever. No longer did you need a huge stockpile of cash or dry powder to take over another company. The impact is present even today as highly leveraged deals continue to persist and financial sponsors keep breaking records for even larger deals.

LikeLike